Temp Agencies

There is new QWI data available by 6-digit NAICS code. My colleague David Wasser used it to look at the space economy. I was interested using it to look at temp agencies.

Why temp agencies? Because the largest sector of employment for individuals involved in the justice system, both before incarceration and especially after release, is “Administrative support and waste management and remediation services” (see Table 7 in this report on federal prisoners). This sector includes some of the jobs you might expect, like janitors (NAICS 561700 - Services to Buildings and Dwellings) and office admin (NAICS 561100 - Office Administrative Services). But it includes Temporary Help Services, or Temp Agencies, which seem like a likely employer for those at the margin of the labor market.

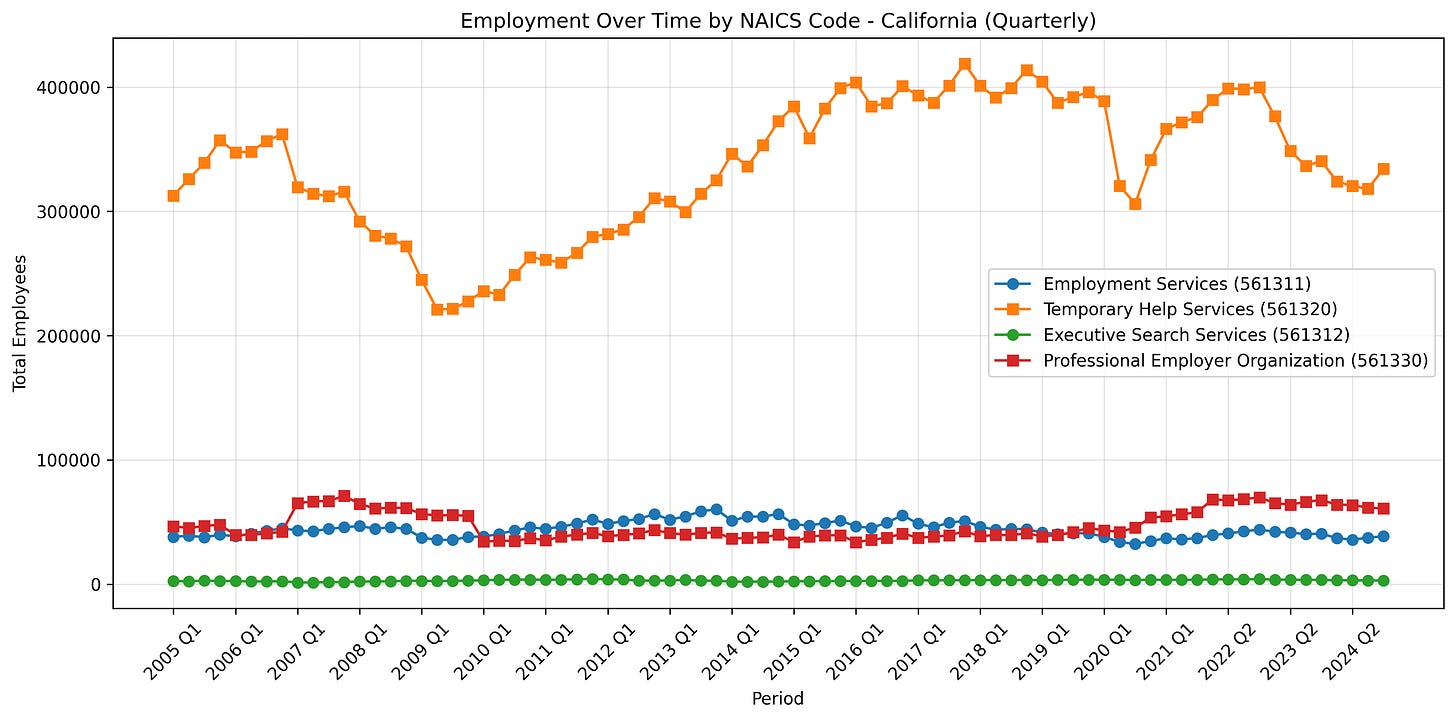

The first thing I learned from the new data is that the previously available data at the 4-digit NAICS code level was probably sufficient for understanding the patterns of temp agency employment. The 4-digit NAICS 5613 (Employment Services) includes four different 6-digit industries:

Temporary Help Services (561320)- likely a major employer of the formerly incarcerated individuals

Employment Services (561311)- firms that list jobs, but typically do not hire workers directly (probably still important for the formerly incarcerated, and the type of firm discussed in this paper, but unlikely to account for high employment levels in Sector 56)

Executive Search Services (561312)- likely less relevant

Professional Service Organizations (561330)- also likely less relevant

Comparing the employment for these industries for California, it is clear that temp agencies dominate employment within NAICS 5613. As a result, most of the patterns observed at the 4-digit level are almost certainly being driven by temp agencies.

That said, it’s still useful to be able to zero in on Temporary Help Services (NAICS 561320) themselves. Even if the other industries are a small share of total employment, their workforces may have very different demographics from the employees of temp agencies and could obscure our understanding of who works for these firms.

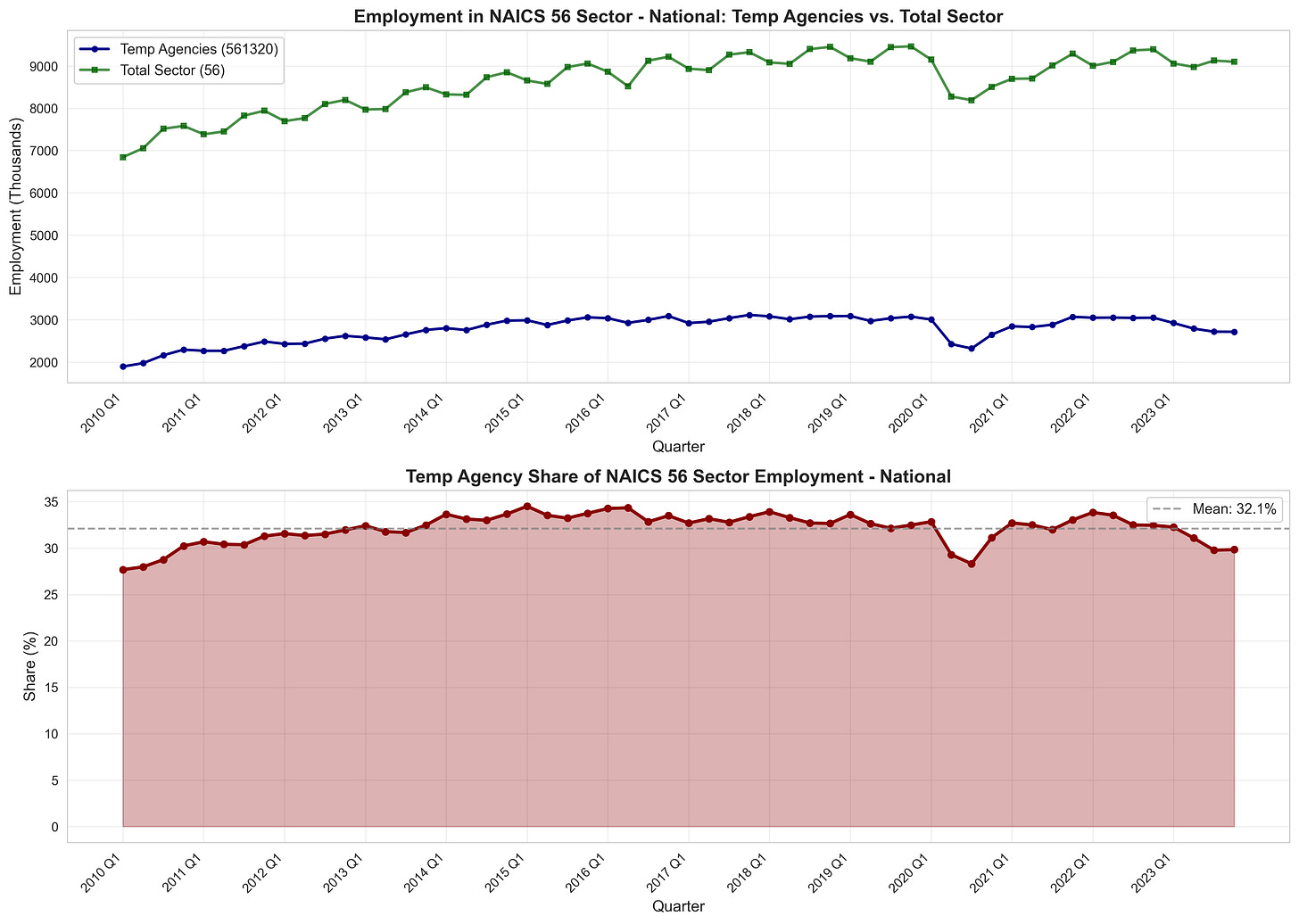

Temp agencies are about 30% of Sector 56 employment. Employment fell in Dot-Com bust, then rose over the next 5 years, then stayed steady at around 3 million employees until 2020. After recovery in 2021, there has been a recent drop in temp agency employment.

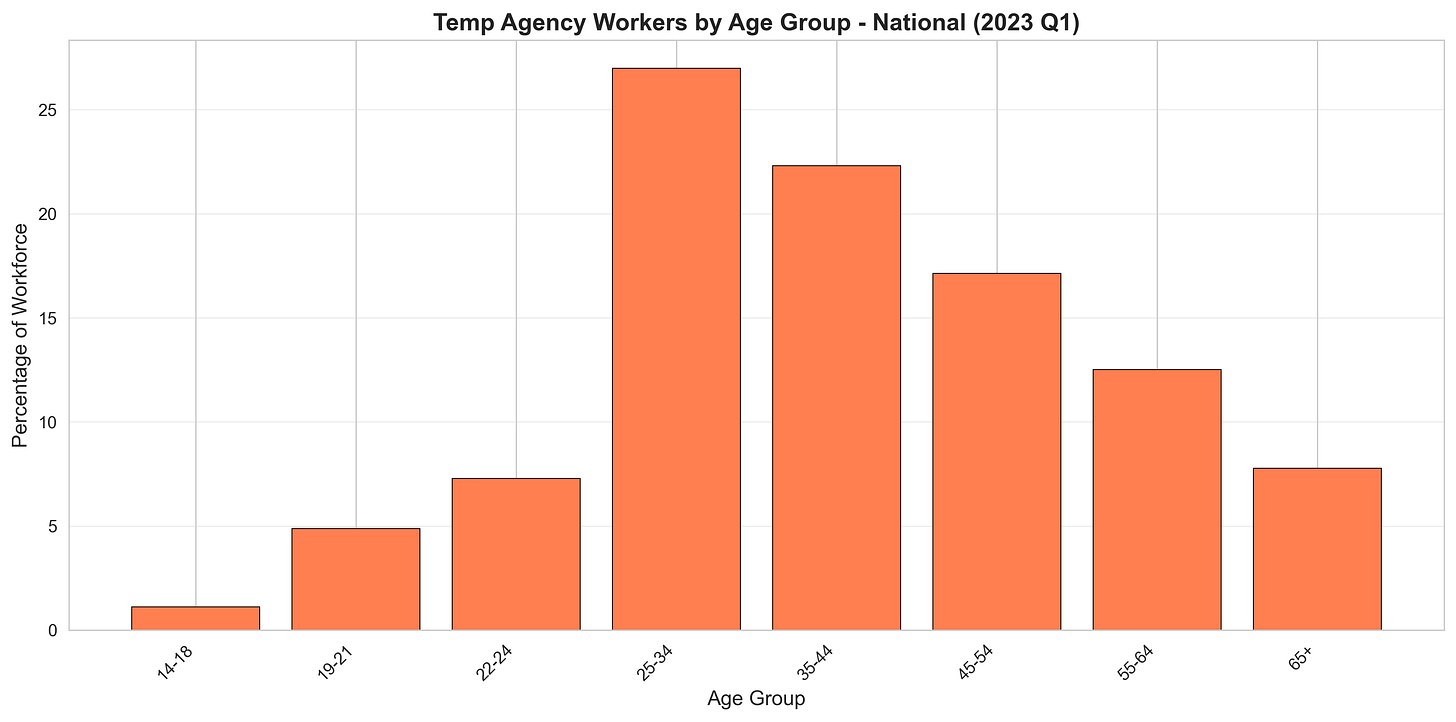

Looking just at a recent quarter (2023 Q1): Men and women are equally likely to work in temp agencies (49.3% versus 50.6%). The workforce is mostly older than 25, but employment decreases by age after the 25-34 age group.

To get a sense of what temp agency workers actually do, I looked at the public use information on industry from the BLS Industry-Specific Occupational Employment and Wage Estimates Some of the largest occupation categories are “Transportation and Material Moving Occupations”, “Production Occupations” and “Office and Administrative Support Occupations”.

For transparency, I put together these figures and statistics with the help of Claude Code, and have not gone through the code as thoroughly as I would if it were a research paper rather than a blog post. But you can, if you want, and tell me where I and the AI have messed up. The GitHub repository is here.