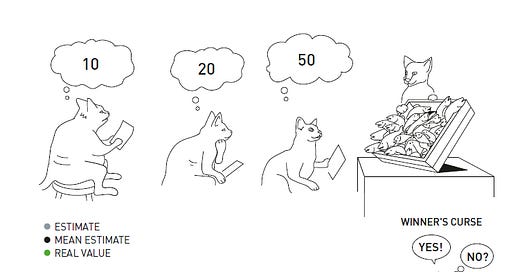

Chart of the Day: The winner's curse as demonstrated by cats at a fish auction

I didn’t post anything about the Econ Nobel Prize announced on Monday to Paul R. Milgrom and Robert B. Wilson, mostly because auction theory is outside my area of expertise. But I really like this illustration provided along with the announcement. Just in case others have not seen it, I’m posting it here as my Chart of the Day.

A really light touch explanation of what the illustration shows (given it’s been a while since I took coursework on auction theory and haven’t done anything with it since): each cat has its own private value for the box of fish. If the skinny cat bids its value of 50, it will get the fish. But it could have also had the fish for 21 (dollars? pouches of catnip? what do these cats uses as a means of trade?) and then had a surplus of 29.

If you win an auction of this type, where you don’t know the true market value, you probably overpaid. That’s the winner’s curse. To avoid the winner’s curse, you might be tempted to underbid. But that can mess you up too, since you may miss out on something that you value if someone outbids you.

Auction theory and market design are about identifying these incentive problems (with auctions and markets more generally) and coming up with ways to fix them.

There are better people to explain this than me. I like this thread by Mohammad Akbarpour and Shengwu Li.

One more thought on the Econ Nobel and other similar honors. I was excited when Ether Duflo was named as a recipient last year, as the second woman to receive the Econ Nobel. I would have been excited to see another woman this year. And we should make sure the economics profession does not discount the achievements of women and non-white men as we move forward. But we should also not discount the achievements of those at the top of our profession that don’t check off demographic boxes. Increasing the diversity of our profession is a marathon, not a sprint. The trends need to go in the right direction, not individual events.